Optimism remains high that the qualified opportunity zone program will assist in rebuilding distressed communities in opportunity zones post-pandemic given the increase of capital gain investment in qualified opportunity funds.

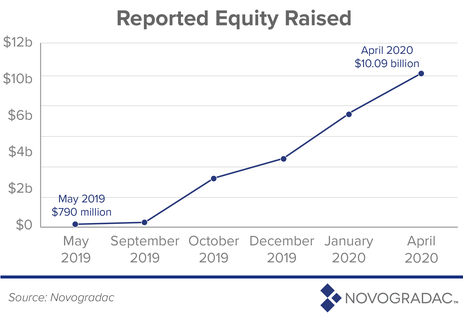

Since the Secretary of the United States Department of Health and Human Services declared a public health emergency on January 31, 2020, under section 319 of the Public Health Service Act (42 U.S.C. 247d) and the President of the United States issued an emergency declaration under the Robert T. Stafford Disaster Relief and Emergency Assistance Act in response to the COVID-19 pandemic, coupled with numerous shelter-in-place executive orders issued by the governors of most states with reopening plans now in their beginning stages, should one be hopeful that the qualified opportunity zone program will help rebuild America? A recent article published by Novogradac & Company, LLC states that their qualified opportunity fund tracking list has surpassed $10 billion as a conservative estimate, which is a significant increase since January.

Specifically, “funds on the Novogradac Opportunity Funds List report have raised $10.09 billion. That is an increase of $3.37 billion (50 percent) over the $6.72 billion reported in early January- and continues a steady increase in equity reported raised since Novogradac began tracking investment activity 11 months ago.” (“Novogradac Opportunity Funds List Surpasses $10 billion in investment,” Michael Novogradac, April 29, 2020). Furthermore, the “list doesn’t include proprietary or private funds owned and managed by their principal investors” and therefore the amount of investment could be much higher. Id.

The article points to the drop in the stock market creating unplanned recognition of capital gains with those investors facing a decision whether to defer those taxes and assist distressed areas with the tax benefits associated with qualified opportunity funds. However, the increase in qualified opportunity fund investment may be due to clarity in the final qualified opportunity fund regulations that were published in the Federal Register on January 13, 2020 having an effective date on March 13, 2020. In fact, clarity was the goal of the final qualified opportunity fund regulations and a likely necessity for large institutional investors.

In order to assist post pandemic recovery in the qualified opportunity zones, the IRS issued Notice 2020-23 on April 10, 2020 providing, among other things, that the 180-day time period from the realization of the capital gain into a qualified opportunity fund has been extended for all tax files until July 15, 2020, provided that 180-day period would have otherwise expired on or after April 1, 2020 and before July 15, 2020.

Requests are also being made to the IRS to extend certain other deadlines, such as the 30-month substantial improvement clock for an additional year. We will keep you posted as these matters proceed.

View all content by Brad Carney, Esq.