Need additional public funding? Updated every two years, the EPA’s Brownfields Federal Programs Guide is an essential resource for communities looking to finance brownfields redevelopment projects. When considering the funding available, it’s important for stakeholders to think beyond the EPA. Indeed, help could come from federal agencies ranging from the Department of Defense to the[…]

Investor alert! An Opportunity Zone Prospectus has been developed for the city of Belfast, Maine. Situated in the heart of Maine’s coastal region, Belfast is located 45 miles from Maine’s capital of Augusta, 30 miles from the City of Bangor, and 80 miles from Maine’s largest city of Portland. The City is known for its[…]

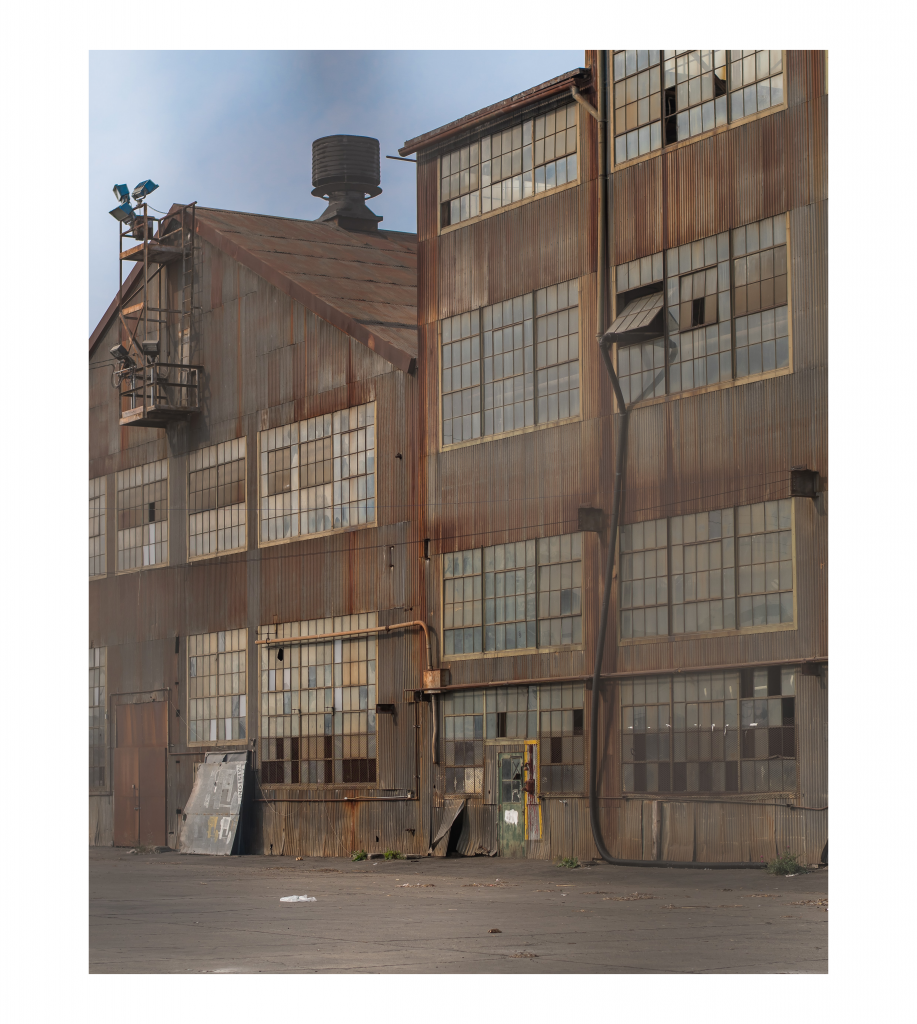

by guest blogger Kat West of Skeo Solutions On November 1, 2020, EPA’s Superfund Redevelopment Program released a fact sheet that promotes opportunity zones to help revitalize contaminated and formerly contaminated property, including Superfund sites. Often called ‘once in a lifetime’ tax benefits, opportunity zones represent a significant incentive for Superfund redevelopment across the nation. Approximately 343[…]

On June 4, 2020, the Department of Treasury and IRS issued Notice 2020-39. This Notice modifies the deadlines contained in Notice 2020-23 as described in my May 21st article. The new Notice issued on June 4th provides additional extensions of time to investors of qualified opportunity funds (QOFs) in response to the COVID-19 pandemic. Specifically,[…]

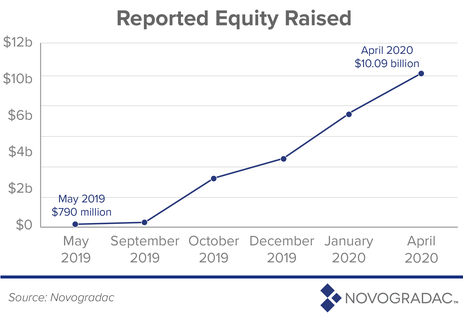

Optimism remains high that the qualified opportunity zone program will assist in rebuilding distressed communities in opportunity zones post-pandemic given the increase of capital gain investment in qualified opportunity funds. Since the Secretary of the United States Department of Health and Human Services declared a public health emergency on January 31, 2020, under section 319[…]

The US Environmental Protection Agency recently announced that 151 communities and tribes were selected to receive $65.6 million in EPA Brownfields funding to assess, cleanup, and redevelop underutilized properties. These funds will assist communities in recycling vacant and abandoned contaminated properties for new and productive reuses. Nearly 30% of the communities selected are receiving brownfields[…]

Hear the latest on IRS clarifications on Opportunity Zones and discover how smaller, rural and tough communities are using this tool to attract investment. Join the conversation in re-positioning your site or community to bring in equity investments for the long-term. Hear the latest from communities as diverse as Lorain, Ohio, Millinocket, Maine, and East[…]

Final regulations governing Qualified Opportunity Funds were published in the Federal Register on January 13, 2020. They will become effective on March 13, 2020 and they address two rounds of public notice and comment. Among the new provisions is the inclusion of a brownfield as “original use” that commences with the qualified opportunity fund to[…]

The Treasury Department recently finalized its regulations governing Qualified Opportunity Funds. Slated to take effect on March 13th, they serve as the rules of the road for investors and developers alike. The final regulation details how investments and their resulting gains will be treated for federal tax purposes, allowing Opportunity Fund investors to understand how[…]